Calculate paycheck after 401k contribution

Hourly Paycheck Calculator Enter up to six different hourly rates to estimate after-tax wages for hourly employees. You can enter your current payroll information and deductions and then.

Solo 401k Contribution Limits And Types

Companies offer this popular option to help employees save for retirement with contributions deducted from each paycheck.

. Use this calculator to see how increasing your contributions to a 401 k can affect your paycheck as well as your retirement savings. Federal 401k Calculator Results. The 401 k Calculator can estimate a 401 k balance at retirement as well as distributions in retirement based on income contribution percentage age salary increase and investment.

This calculator is designed to show you how you could potentially increase the value of your retirement plan account by increasing the amount that you contribute from each paycheck. Gross Pay Calculator Plug in the amount of money youd like to take home. Second multiply your gross income per pay period by the.

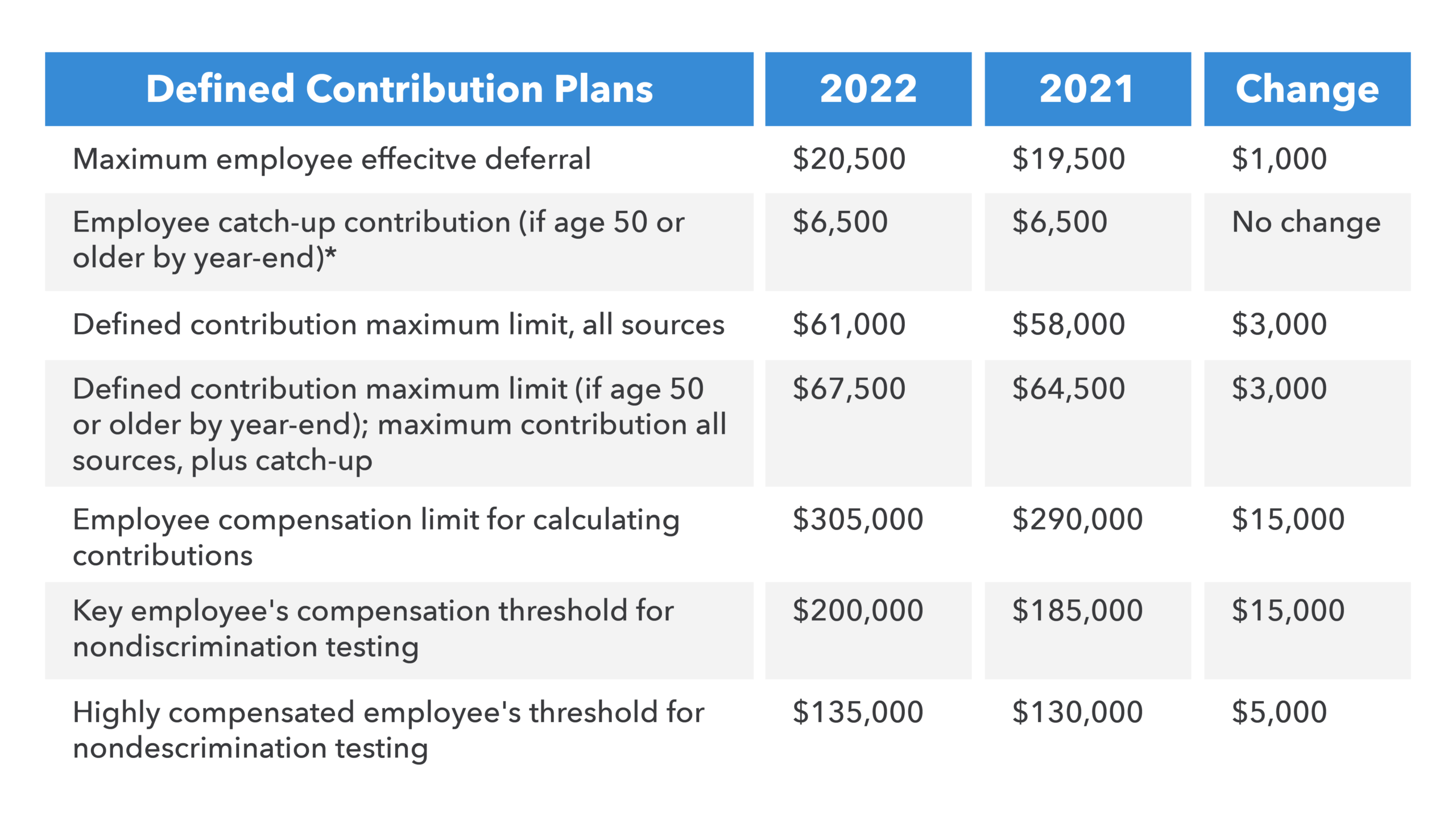

Ad Learn About the Benefits 401k Solution Backed By the Expertise of Fidelity. Learn About 2021 Contribution Limits Today. We encourage you to talk to an.

7000 Small Businesses Trust Human Interest With Their 401ks 403bs. A 401 k can be one of your best tools for creating a secure retirement. First divide your annual salary by the number of pay periods per year to calculate your gross income per pay period.

Paycheck Calculator Use this calculator to help you determine the impact of changing your payroll deductions. 401k Contribution Calculator Retirement Contribution Effects On Your Paycheck Calculate your earnings and more An employer sponsored retirement savings account could be one of your. Retirement Age Step 2.

A One-Stop Option That Fits Your Retirement Timeline. Gross pay This is your gross pay before any deductions for one pay period. Ad If you have a 500000 portfolio get this must-read guide from Fisher Investments.

This calculator is provided only as a general self-help tool. When you make a pre-tax contribution to your. Transparent Pricing Plans From 120mo 4Employee.

Below are your federal 401k details and paycheck information. It provides you with two important advantages. This calculator is designed to show you how making a pre-tax contribution to your retirement savings plan could affect your take home pay.

This calculator uses the latest withholding. This calculator uses the latest. About Your Savings Enter what you have currently saved how much you could put in a monthly contribution to a 401 k and how much your employerthe business.

Use this calculator to see how increasing your contributions to a 401 k 403 b or 457 plan can affect your paycheck as well as your retirement savings. Learn About 2021 Contribution Limits Today. First all contributions and earnings to your 401 k are tax deferred.

Ad Discover The Benefits Of A Traditional IRA. Strong Retirement Benefits Help You Attract Retain Talent. If you increase your contribution to 10 you will contribute 10000.

The accuracy or applicability of the tools results to your circumstances is not guaranteed. To get a detailed future analysis of your 401k fill out the 401k Future Value Analysis form. A One-Stop Option That Fits Your Retirement Timeline.

Your employers 50 match is limited to the first 6 of your salary then limits your employers contribution to 3000 on a. Subtract your 401 k contributions from gross income before calculating federal income tax the only federal withholding tax that 401 k pretax contributions are exempt. Ad Easy-Setup SMB Retirement Plans.

The most common pre-tax contributions are for retirement accounts such as a 401k or 403b. Ad Discover The Benefits Of A Traditional IRA. Pay period This is how often you are paid.

401k plans let you invest in mutual funds and. So if you elect to save 10 of your income in your companys 401k plan 10 of your pay will. Please enter a dollar amount from 1 to 1000000.

Strategies For Contributing The Maximum To Your 401k Each Year

Excel 401 K Value Estimation Youtube

After Tax Contributions 2021 Blakely Walters

Free 401k Calculator For Excel Calculate Your 401k Savings

Solo 401k Contribution Limits And Types

401k Contribution Impact On Take Home Pay Tpc 401 K

401k Contribution Impact On Take Home Pay Tpc 401 K

Corporation Calculating My Solo 401k Contributions For A Corporation My Solo 401k Financial

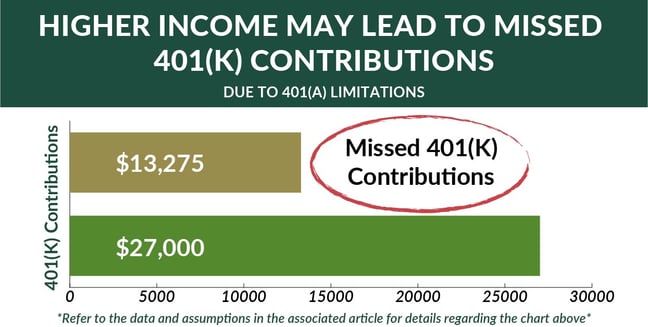

401 K Income Limits The Mistake Executives Earning Over 305 000 Make All The Time

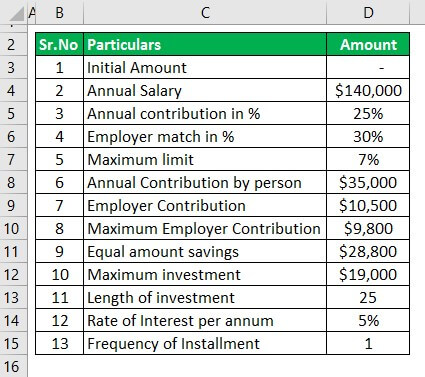

401k Contribution Calculator Step By Step Guide With Examples

Solo 401k Contribution Limits And Types

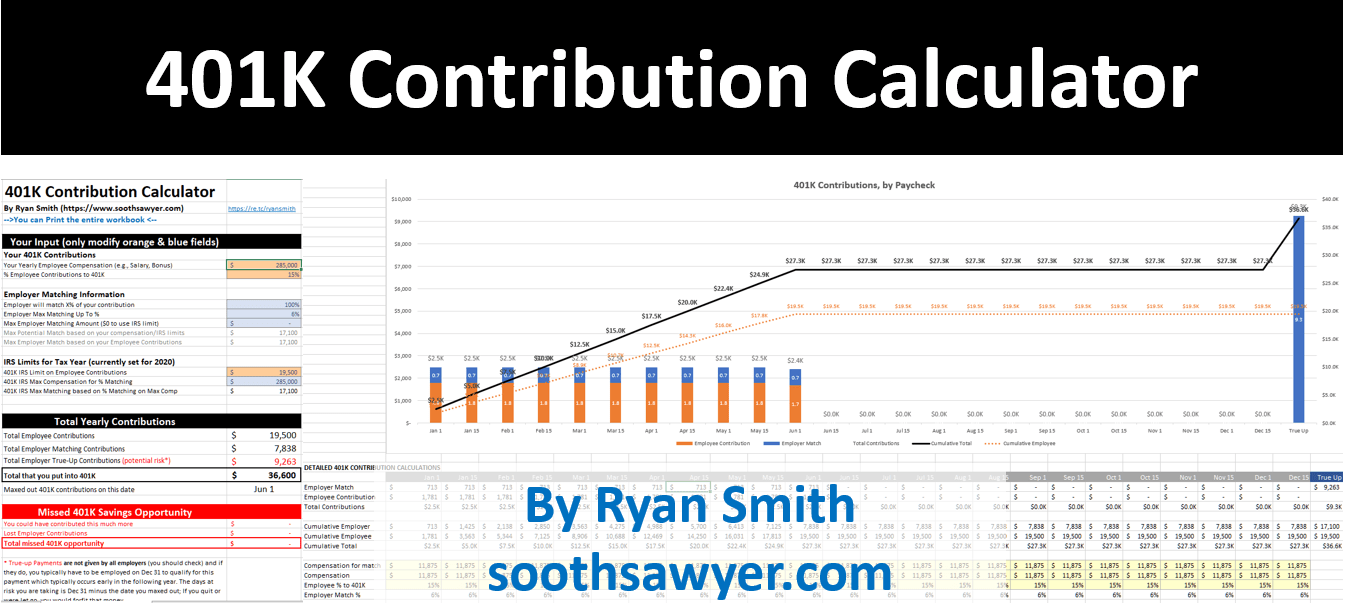

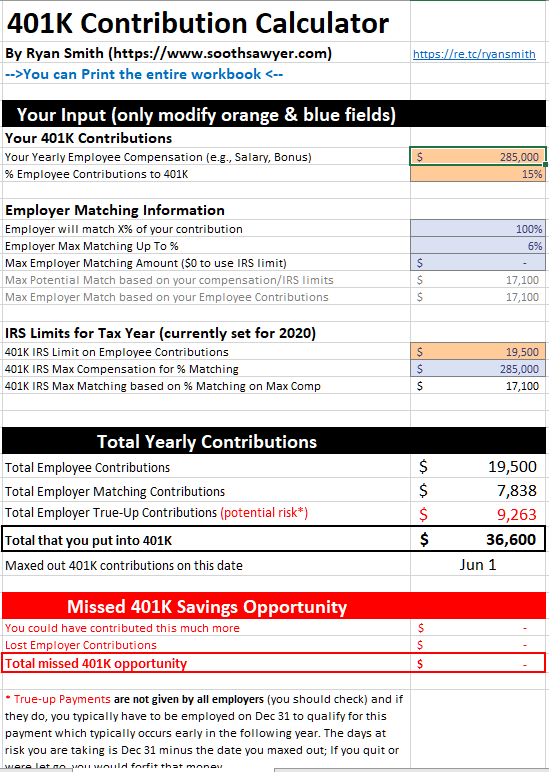

401k Employee Contribution Calculator Soothsawyer

/how-do-401k-tax-deductions-work-90f14263254d470fb07b75f2bf664174.png)

How Do 401 K Tax Deductions Work

How Much Can I Contribute To My Self Employed 401k Plan

401 K Plan What Is A 401 K And How Does It Work

401k Employee Contribution Calculator Soothsawyer

How Much Can I Contribute To My Self Employed 401k Plan